2022-08-25

Staking & liquid staking on Nightly Wallet

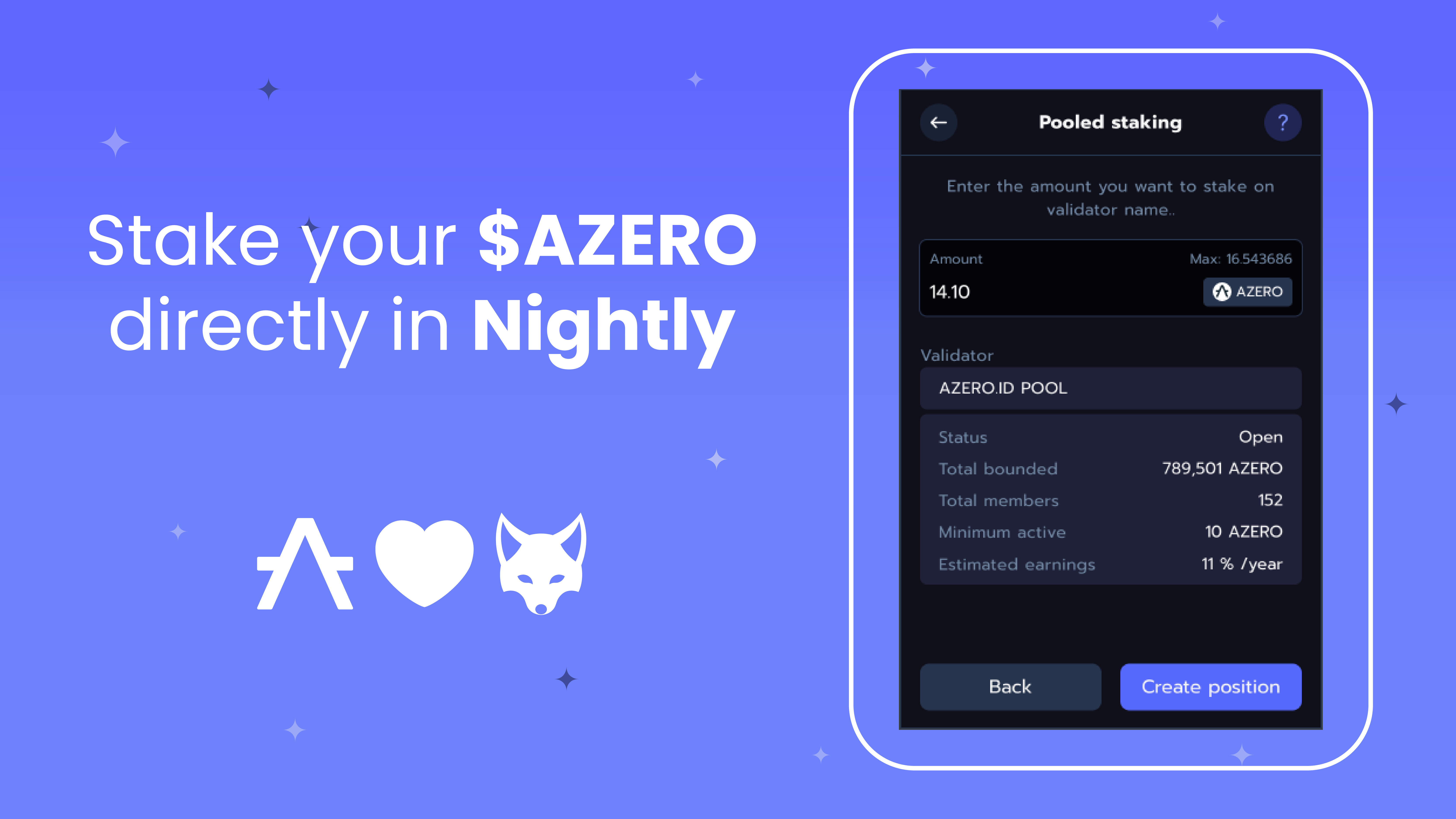

From now Nightly is giving you an opportunity to stake your tokens directly in the wallet

As you know, we are growing and enhancing our services for your better usage.

The time for staking, and very soon liquid staking in Nightly Wallet has come. You can stake your coins in the Nightly wallet, on NEAR and Solana blockchain.

Also, you will be able to do it on Aptos soon :)

In this blog post, we will introduce to you, what is the difference between staking and liquid staking, and how to do it in our wallet

What is staking?

Staking is the process of supporting the validation of a blockchain network type Proof of Stake. How does it work? It is all about locking your funds out of circulation in your wallet or other platforms. Of course, you will get rewards for helping in increasing the security and efficiency of the chain.

What is liquid staking?

Liquid staking also lets you get rewards but the main difference between it and traditional staking is that you don’t have to freeze your assets or maintain the whole staking infrastructure (to be exact, you have to lock your token, but then you will receive a new one). Like in staking, users can deposit tokens but they will receive liquid tokens in return. To put it simply, liquid staking integrates profits of staking which is getting rewards and some extra opportunities to increase your funds by participating in DeFi.

Liquid staking on NEAR is available thanks to our friends from Metapool and on Solana thanks to Lido.

What is the difference between them?

As mentioned above, the main difference is that in liquid staking there is no need to freeze your assets and support staking infrastructure. What is more, and maybe more technical, when you decide to freeze your assets anyway in liquid staking you will get tradable tokens that you won’t have a chance to get in traditional staking. You can use your token as you want - mint it, get more rewards or put it as collateral. It depends on you. The last difference is that regular staking is available in our wallet and liquid staking is not yet, but it is only a matter of time.

What is better: staking or liquid staking?

Let’s start by saying that these methods have more in common than differences. Both are DeFi trading methods and most of your results depend on your strategy. To decide which is better you need to clarify your goal. If you want to put your money into staking and forget about them, you should probably choose regular staking. This will provide you with rewards after the process. The case is a little bit different when you have an active strategy and you are aware of how to use tradable tokens. If you feel confident enough to try making more money, you suppose to try liquid staking.

Where can you find it in Nightly Wallet?

- First of all, you suppose to choose NEAR or Solana blockchain, because staking is available only on these chains as far.

- You are supposed to choose the right token after that (NEAR token when you use NEAR blockchain and Solana token when you use Solana blockchain).

- Next, click the button “start earning” which is below the “deposit” and “send” buttons.

- Choose “regular staking” or “liquid staking”.

- You will notice a list of your staking positions, and just click a plus on the right upper corner.

- After that, you need to only choose the validator and decide what amount of tokens you want to stake.

- Last but not least, click the button “next”. That is all.

- You just have staked your tokens.

It is a piece of cake, isn’t it?

We hope this blog post has helped you and explained some basic info about this topic. Now, you can define the differences between traditional staking and liquid staking and find the pros and cons of each one.

You’re ready to allocate your funds, keep waiting for the possibility to start liquid staking which will be available soon.

Wish you good luck!

May also interest you

Nightly Connect in a nutshell

How to Build Your First Solana App with Nightly Solana Template dApp

How to stake AZERO tokens using Ledger

How to stake on Aleph Zero - Nightly's tutorial

How to migrate your NEAR wallet in 5 steps

©2022 - Nightly. All rights reserved.